Modalities on Implementation of CBN's Cashless Policy

The Central Bank of Nigeria was established past times the CBN Act of 1958 too commenced operations on July 1, 1958.

The major regulatory objectives of the depository fiscal establishment every bit stated inwards the CBN deed of 1958 is to: keep the external reserves of the country, promote monetary stability too a audio fiscal environment, too to deed every bit a banker of end resort too fiscal adviser to the federal government.

We write to inform you lot of the modalities on the Central Bank of Nigeria’s (CBN) cash-less policy that commenced inwards Lagos on Apr 1, 2012 too July 1, 2013 inwards the Federal Capital Territory (Abuja), Abia, Anambra, Kano, Ogun too Rivers States.

What is the aim of this policy?

The cash-less policy aims at reducing the total of physical cash circulating inwards the economic scheme too encouraging to a greater extent than electronic-based transactions (payments for goods, services, transfers, etc.).

This policy volition crusade evolution too modernization of the country's payment organisation inside these U.S.A. every bit all individuals too corporates volition hold upwards encouraged to adopt electronic payment too banking options.

Operational modalities across the states

The next modalities which are currently operational inwards Lagos State volition likewise hold upwards applicable inwards the newly introduced States*:

*However, charges conduct hold been deferred inwards the newly introduced states till Oct 1st, 2013.

Kindly greenback that the to a higher house limits apply too thence far every bit it involves cash, irrespective of channel i.e over the counter, ATM, tertiary political party cheques cashed over the counter etc. For example, if an private withdraws N450,000 over the counter, too N150,000 from the ATM on the same day, the full total withdrawn past times the client is N600,000, too the service accuse volition apply on N100,000 - the total to a higher house the daily gratuitous boundary of N500,000.

Exemptions to modalities nether operation

Exemptions conduct hold soundless been granted on lodgments too withdrawals for accounts operated past times Embassies, Diplomatic Missions, Multilateral Agencies, Aid Donor Agencies, Ministries, Departments too Agencies of Government (revenue collections only), Microfinance Banks (MFBs) too Primary Mortgage Institutions (PMIs).

What you lot should do

To ensure a seamless transition to a cashless economy, banks conduct hold made several prophylactic too convenient alternative channels available to the full general world for personal too line of piece of occupation concern banking. These channels include mobile money, network banking, yell banking, POS, ATM, cards, social banking, etc etc.

You may create good to start out preparing your hear first, too taking concrete steps, toward accepting too ensuring a seamless transition into the cash-less guild that must come, whatever our views.

Contact your depository fiscal establishment for detailed data on the many electronic channels available to you.

The Central Bank of Nigeria was established past times the CBN Act of 1958 too commenced operations on July 1, 1958.

The major regulatory objectives of the depository fiscal establishment every bit stated inwards the CBN deed of 1958 is to: keep the external reserves of the country, promote monetary stability too a audio fiscal environment, too to deed every bit a banker of end resort too fiscal adviser to the federal government.

We write to inform you lot of the modalities on the Central Bank of Nigeria’s (CBN) cash-less policy that commenced inwards Lagos on Apr 1, 2012 too July 1, 2013 inwards the Federal Capital Territory (Abuja), Abia, Anambra, Kano, Ogun too Rivers States.

|

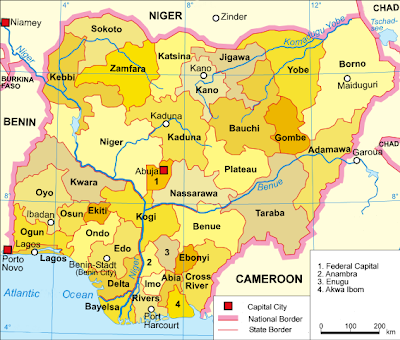

| Map of the Federal Republic of Nigeria |

What is the aim of this policy?

The cash-less policy aims at reducing the total of physical cash circulating inwards the economic scheme too encouraging to a greater extent than electronic-based transactions (payments for goods, services, transfers, etc.).

This policy volition crusade evolution too modernization of the country's payment organisation inside these U.S.A. every bit all individuals too corporates volition hold upwards encouraged to adopt electronic payment too banking options.

Operational modalities across the states

The next modalities which are currently operational inwards Lagos State volition likewise hold upwards applicable inwards the newly introduced States*:

- The cash-in-transit lodgment too cash evacuation services volition no longer hold upwards available to customers or merchants.

- For individual line of piece of occupation concern human relationship holders, charges volition apply when daily cumulative withdrawals too deposits are inwards excess of N500,000

- For corporate line of piece of occupation concern human relationship holders, charges volition apply when daily cumulative withdrawals too deposits are inwards excess of N3,000,000

- The Cashless policy applies to all accounts including COLLECTION accounts i.e. all sub-accounts linked to the same line of piece of occupation concern human relationship holder would hold upwards treated every bit 1 line of piece of occupation concern human relationship for both corporate too private accounts.

| Deposit | Withdrawal | |

| Individual | 2% on excess | 3% on excess |

| Corporate | 3% on excess | 5% on excess |

*However, charges conduct hold been deferred inwards the newly introduced states till Oct 1st, 2013.

Kindly greenback that the to a higher house limits apply too thence far every bit it involves cash, irrespective of channel i.e over the counter, ATM, tertiary political party cheques cashed over the counter etc. For example, if an private withdraws N450,000 over the counter, too N150,000 from the ATM on the same day, the full total withdrawn past times the client is N600,000, too the service accuse volition apply on N100,000 - the total to a higher house the daily gratuitous boundary of N500,000.

Exemptions to modalities nether operation

Exemptions conduct hold soundless been granted on lodgments too withdrawals for accounts operated past times Embassies, Diplomatic Missions, Multilateral Agencies, Aid Donor Agencies, Ministries, Departments too Agencies of Government (revenue collections only), Microfinance Banks (MFBs) too Primary Mortgage Institutions (PMIs).

What you lot should do

To ensure a seamless transition to a cashless economy, banks conduct hold made several prophylactic too convenient alternative channels available to the full general world for personal too line of piece of occupation concern banking. These channels include mobile money, network banking, yell banking, POS, ATM, cards, social banking, etc etc.

You may create good to start out preparing your hear first, too taking concrete steps, toward accepting too ensuring a seamless transition into the cash-less guild that must come, whatever our views.

Contact your depository fiscal establishment for detailed data on the many electronic channels available to you.

Buat lebih berguna, kongsi: